Financial Planning Services

Inheritance tax mitigation

Investment strategy

Retirement Planning including the use of Income Drawdown Plans and Self Invested Personal Pensions (SIPPs)

Trustee investment

Wealth management

Duncan, Martin, and the team will review all of your options allowing you to make informed decisions about your finances and lifestyle, both now and in future.

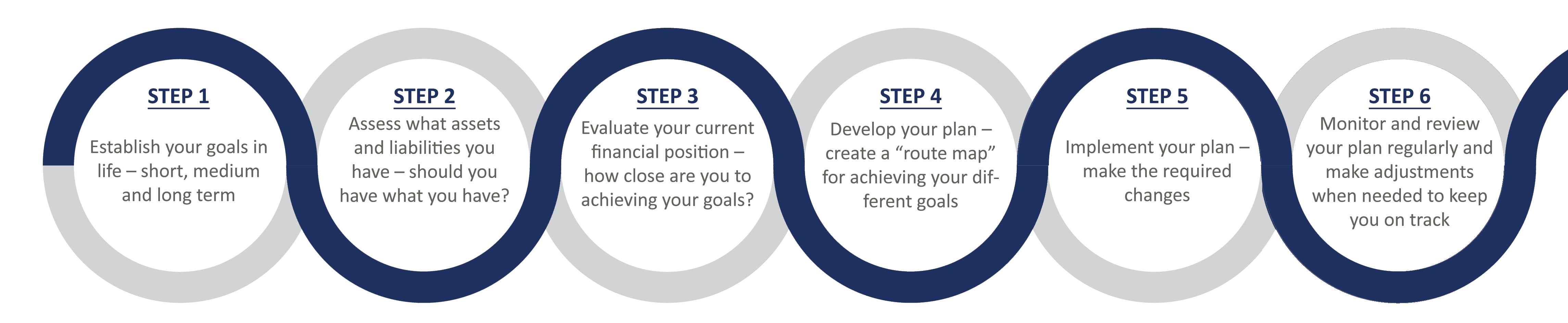

We will create a financial plan based on a six step process:

Can We Help?

After an initial discussion, we start our relationship with you by arranging a no charge and no obligation meeting, usually at your home. This meeting allows to better understand your personal and financial situation, as well as for you to understand the full range of services that we have on offer. After our meeting, we suggest that both parties reflect and see how we can work with each other to add real value.

If it is appropriate for us to proceed, we operate on a fee only basis either at an hourly rate or a fixed fee, agreed in advance. These fees can be met from your investment portfolio or directly from you. Our annual management charge is met from your portfolio and covers on-going advice and planning.

Investment Management

Our core belief is that investments should be easy for our clients to understand. If we can’t explain the workings of an investment to you, the client; then how can we justify holding it on your behalf?

We believe our clients want their investment portfolio to be easy to understand, capable of delivering the returns needed to support spending requirements and predictable in relation to what is happening in the real economic world. We also believe that cost and charges have a significant impact on investment returns and therefore seek and hold low-cost investment structures on behalf of you, the client.

We carry out robust, global research, covering costs, performance and with good old common sense and logic. We aim to deliver predictable risk-rated portfolios to our clients.

We start with you, the client, and your cash flow requirements:

In some form or other, clients typically need their investments to deliver ‘cash to spend’!

By understanding how much money your investments need to provide for you to spend and when, we can build a portfolio aimed at delivering your lifetime cash flow requirements.

Based on the investment sums available and how much money you require from the portfolio to spend, we will discuss and agree how much investment risk you are willing to take and also the risk you need to take to achieve your objectives.

Regular reviews are critical and we review the portfolios at each client review and on a formal quarterly basis, rebalancing the portfolio back to the agreed asset allocation. This ensures the portfolio does not ‘drift’ over time and therefore remains in line with the agreed risk profile.

- Cash flow needs

- Timescales

- Risk assessment

- Asset allocation

- Whole of market review

- Global research

- Keep investment costs to a minimum

- Identify and use the most efficient investment vehicles for minimising tax

- Build a strategy

- Buy and hold – we are long term investors

- Regular reviews and rebalancing of the portfolio

- Regular use of annual Capital Gains Tax allowances where appropriate

- Regular use of your ISA allowances